Business License Tutorial

All persons or companies conducting business within the city limits of Morgan Hill are required to obtain a City Business License. An application must be submitted and fees must be paid prior to the start of business operations. Once issued, a business licenses is valid July through June and must be renewed annually. A Business License is valid only within the city limits of Morgan Hill - while doing business from your commercial / professional location, your residence, or when you are providing services to a resident or business within the city limits.

What kind of business license do I need?

Determine which of the following business types best describes your business:

-Wholesalers

-Manufacturers

-Service providers

-Professionals

-Contractors

-Non-profit organizations

-Self-employed or consultants (home businesses)

-Residential landlords renting 3 or more units

-Mobile Vendors, Peddlers, and Solicitors

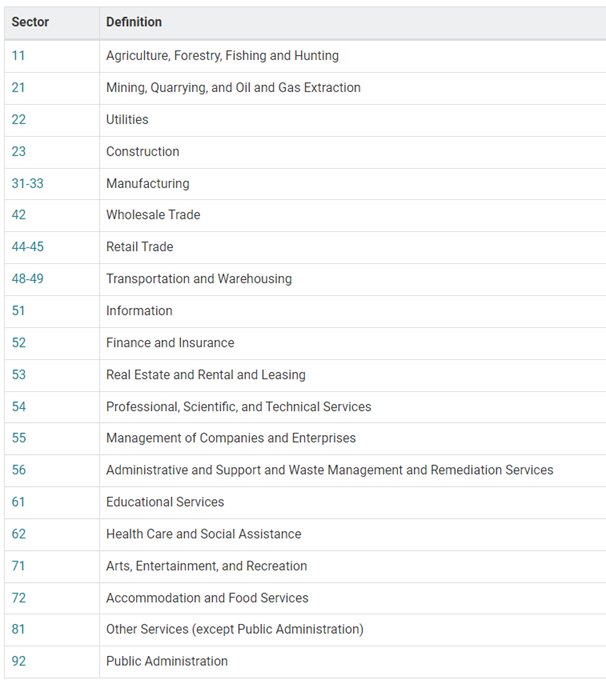

What is my NAICS code?

The North American Industry Classification System (NAICS) groups establishments into industries based on the activity they are primarily engaged. Establishments with similarities such as using the same raw material inputs, similar capital equipment, and similar labor are categorized in the same industry.

NAICS classifies economic activity into twenty different industry sectors by using a six-digit hierarchical coding system. Five sectors are dedicated to goods-producing categories and the remaining fifteen are dedicated to services-providing sectors.

Learn more about NAICS and search for your code HERE.

Doing Business As (DBA) / Fictitious Business Name (FBN)

If the name of your business does not include the last name of the business owner, the State of California requires that you file a fictitious business name (FBN) statement with the Registrar-Recorder/County Clerk's office in the county where the business will be located. After your statement has been filed it must be published once per week for four consecutive weeks, the first taking place within 45 days of the filing date. Lastly, before 45 days after the completion of the last publication, an affidavit showing the publication of the statement needs to be filed with the county clerk where the fictitious business name statement was filed.

For Example: Jayne Seymour wants to open a floral shop. If she names the business Seymour’s Stems she would not need to file for an FBN. However, if she names the business Flowers on Main she would need to file for an FBN since her last name is not part of the business name.

Registering your business as an LLC or Corporation

Ca secretary of state

ABC License

If you will be serving/selling beer, wine or alcohol you will need a permit from Alcoholic Beverage Control (ABC) with the State of California.

Businesses That Require Additional Documentation

The following business types require the submission of additional documentation/certification in addition to a business license application:

Animal Establishment/Kennel- additional permit required

Beauty/Cosmetology (esthetician, )- additional certifications required

Healthcare (acupuncture,

Massage Establishment- additional permit required

Mobile Vender/Peddler-

Taxi Cab Owner/Driver- additional permit required

ATF

Automotive Repair- state license required

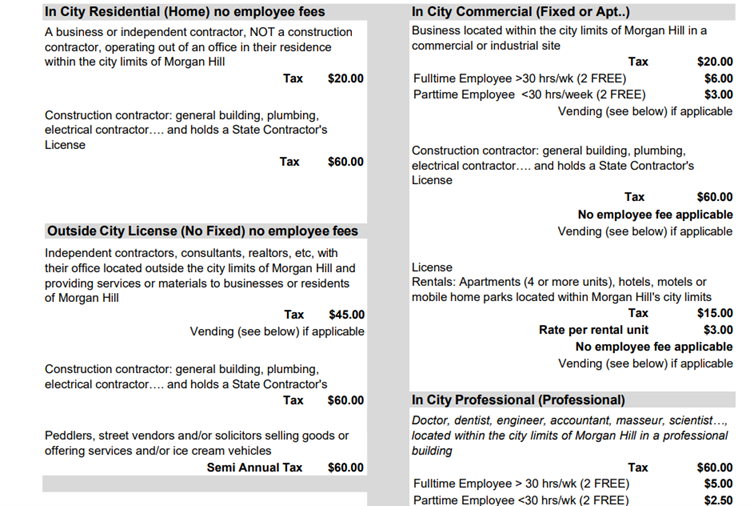

Fees

A variety of classifications and rates are set forth in the Business License Ordinance. A brief rate schedule (PDF) of the most common classifications is available from the Development Services Center. One-time fees charged for processing a new business license application include an application review fee and a zoning permit fee, which ensure your business will be operating in a location where the zoning permits that specific use.

New Business License

-$20 Flat Fee

-$6 Per full-time employee (first two employees are free)

-$3 Per part-time employee (first two employees are free)

-$82 Application Review Fee

-$126 Zoning Review Fee

-$118 Building Review Fee

-$4 Senate Bill 1186 State Mandated Collection Fee

Note: The number of employees for new businesses shall be determined as of the day such business commences

Renewed Business License

-$14.60 Flat Fee

-$4 Senate Bill 1186 State Mandated Collection Fee

Note: The number of employees under this chapter shall be determined by taking the average number of employees (counting all shifts) for the six months preceding the first day of the license year for which the license is issued

Speakers

Innovation & Manufacturing

Join us for a conversation about the efforts to grow and attract jobs in Morgan Hill. Hear from local developers about their plans and their take on the Morgan Hill market. Join the dialog on how to support job creation in Morgan Hill.

Speakers

Will Parker, Trammell Crow

Brian Matteoni, CBRE

Mike Wargocki, Sun Basket

Date: Thursday, October 24

Time: 6:30 p.m. - 8:00 p.m.

Location: Granada Theater

TOURISM

Join us for a half day of fun learning about the tourism and hospitality industry. Hear from local organizations that contribute to our sports/recreation, wine and ag tourism. Learn from other Destination Management Organizations. Share your ideas for growing tourism in the area with the newly formed Visit Morgan Hill group.

Date: Monday, October 28

Time: 8:00 a.m. - 1:00 p.m.

Location: Rosewood Cordevalle, San Martin, CA

FAQs

If I move my business to a new location in Morgan Hill, do I need to apply for a new business license?

Yes. A new location will require a new business license to ensure that the zoning and use are compatible at the new address.

If I purchase an existing business, and do not plan to move it to a new location, do I need to apply for a new license?

Yes.

If my business operates in multiple locations, do I need to apply for a separate business license for each location?

Yes. A separate license must be obtained for each branch establishment or location of the business transacted and carried on.

Are there any business operators that are exempt from paying the business license fee?

Yes. Charitable/non-profit organizations and veteran-owned businesses are exempt from paying fees, however they are still required to submit a business license application.

If I plan to run my business out of my home, do I have to list my home address as my business license?